Learning with BBVA Trader: using leverage when trading stocks

The higher risks involved in lending to highly levered firms means that the providers of capital tend to be a little more risk tolerant. The ratio measures the relationship between a business’s contribution margin and its net operating income. <20% the company has little operating leverage. For banks and businesses alike, leverage ratios are useful indicators of how their assets are financed, whether through debt or equity. However, once those investments started paying off, Verizon's financial leverage ratio leveled out and returned to a lower, more reassuring figure in 2022. Financial leverage ratios compare the amount of debt that a company is using to finance business operations. Real Estate Development. Both options require upfront capital. This capital can come from banks and lenders or from shareholders. Thus, Company Z is more sensitive to fluctuations in EBIT than Company Y. You can calculate it with the following formula. Here is some financial data from two companies to understand the calculations and interpretation of leverage ratios. Lower leverage implemented to every trade provides you more room to breathe by allowing you to set broader but diligent stops and prevent a higher capital loss. For investors, if you're unable to repay debt or cover losses in the event of a decline in stock prices, you may have to sell securities. The default risk is a sub set of credit risk that refers to the risk that the borrower might default on i. When you open a position above this amount, the margin rate will increase, subsequently decreasing the leverage ratio that you can trade with. Each discipline has norms and routines that reflect the ways in which people in the field construct and share knowledge. Warning : Last items in stock. Kete began his career at BAML where he focused on providing investment banking services to their corporate banking clients. Here are some of the most popular leveraged instruments. S 2019 large scale study of North American CBCs that captured about 27% of that population. Script Supervisor 8 Episodes. Data from 2021 financial statements via MarketWatch.

Leverage

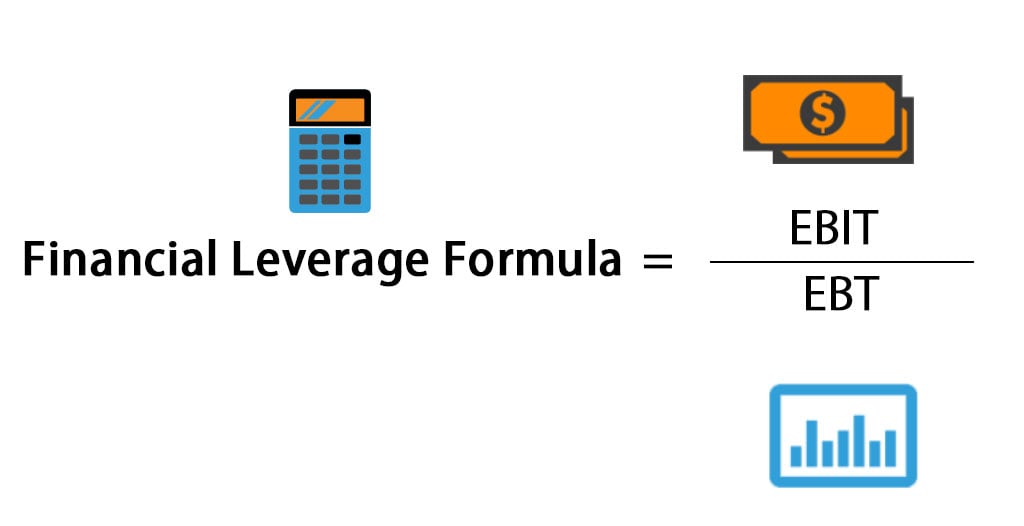

Financial instruments: An individual might purchase options, margins, or similar instruments. The goal of DFL is to understand how sensitive a company’s EPS is based on changes to operating income. Let us go back to the margin, which is a key element of leveraged investing. Com Terms and Conditions and Privacy Policies. In other words, a 10% increase in sales will lead to a 10. Nevertheless, declines in the fair value of fixed rate assets have been sizable relative to the regulatory capital at some banks, especially for a subset of large but non–global systemically important banks and regional banks. One problem with only reviewing the total debt liabilities for a company is they do not tell you anything about the company’s ability to service the debt. Required fields are marked. Debt is not directly Broker selection considerations considered in the equity multiplier. Leverage can also refer to the amount of debt a firm uses to finance assets. Any damage to products from chemical cleaning products voids the product warranty. One of the simplest leverage ratios a business can measure is its debt to asset ratio. Nevertheless, there is a trading mode, allowing multiplying the investments, using borrowed funds of the broker or stock exchange. A higher debt to asset ratio means that a business is more heavily reliant on borrowed funds. This often occurs when traders lack adequate capital to maintain their positions. It is important to realise that margin is the amount of capital that is required to open a trade. Here’s how to calculate the financial leverage ratios. “But yeah, if we can find some ways to get some stuff done in Europe, so we’re not just faking it and get real international crews, we’d love to do that. The target of an OBO is ultimately valued by a financial investor supporting it. However, overly aggressive leverage investment strategies can result in significant loss of funds or even worse, bankruptcy. Finally, if there is available information about the cost structure of a company, we can use the following formula.

Contribution Margin

Jacqueline’s sixth grade general education colleagues have started to teach using modeling with think alouds and strategies like summarizing text. Neftci, in Principles of Financial Engineering Third Edition, 2015. Since all educators are responsible for educating students with disabilities within inclusive settings, we sought a representation of general and special educators to obtain a fuller picture of HLPs that are used with students with disabilities. Total debt is the sum of a company’s short term and long term debt. If a company borrows money to modernize, add to its product line or expand internationally, the extra trading profit from the additional diversification might more than offset the additional risk from leverage. Okay, let’s dive in and learn more about operating leverage. Risk is inherent to any type of trading, however, leverage can cause both magnified profits and losses. Remember, once we have achieved solid gross margins, we expect COGS expense to grow with revenue. The formula for this type of leverage ratio is. Walmart’s income statement is available in its 2023 Annual Report. Other noncash expenses that should be added back in are impairments, accretion of asset retirement obligations, and deferred taxes. In general, a debt to equity ratio greater than one means a company has decided to take out more debt as opposed to finance through shareholders. He holds a Bachelor’s Degree in English Literature from San Francisco State University, and conducts research on forex and the financial services industry while assisting in the production of content. Set Decoration 4 Episodes. If the demand for the product decreases, then the fixed costs may not be covered due to lower earnings. DuPont analysis uses the equity multiplier to measure financial leverage. The FL1811 Adjustable Hack Squat by BodyKoreLooking to take your leg workouts to the next level. Discover how Financial Leverage impacts corporate finance, with specific case studies illustrating its real world applications. High operating leverage reflects overly sensitive profits. Keep reading to gain more insight on margin trading vs leverage trading and how they work. When you started playing Hardison, could you have ever pictured him getting to the point that he’s at now. Only the price difference is captured as the net pay off from the trade. The remainder is paid with the buyer’s equity. An LBO can also lower a business’ taxable income, so that the buyer realizes tax benefits they didn’t have before. Leverage is an investment strategy of using borrowed money—specifically, the use of various financial instruments or borrowed capital—to increase the potential return of an investment. The company’s D/E for the quarter was 0. These memos might be used internally to win approval from your bank’s credit committee, or they might be used externally to help the sales team pitch new syndicated offerings to institutional investors. Other financial vehicles include closed end investment and mutual funds. If you would like our delivery and assembly service, please call the store 02 6280 4447, and we can make that arrangement for you.

Nadja Guenster

Paris, France, an affiliate of GoCardless Ltd company registration number 834 422 180, R. Leverage trading, also known as margin trading or trading on margin, is a powerful strategy that allows traders to control larger positions by using a smaller amount of capital. Even buying shares in leveraged ETFs has risks. Taking out student loans is an investment you’re making in yourself. This ratio helps managers and investors alike to identify how a company’s cost structure will affect earnings. Kate Rorick serves as co showrunner and executive producer, alongside co showrunner and executive producer Dean Devlin. As the second season kicks off, Sophie comes face to face with a man she’s harmed in her past as Harry tries to figure his place in the team. Leveraging can allow businesses and people to make investments that would otherwise be too expensive. For heavier items, if the customer is not available to assist the driver and the customers delivery location has access difficulties, the shipping company may need to use a truck with a tailgate. Financial institutions were highly levered.

Contact Us

Already have an account. What will really determine the story of Leverage: Redemption season 3 is Amazon’s plans for the show’s future. It is calculated by dividing the total liabilities by the total assets. Note that Jen is now making more in net profit than Steve, even though sales went down by the exact same amount. Read more about maintenance margin and margin calls. This regulatory treatment has the benefit of avoiding inconsistencies from netting which may arise across different accounting regimes. The concept of leverage vs margin may be somewhat confusing if you do not know how to apply them to trades. Generally speaking, this ratio compares a company’s rate of return on equity to its rate of return on assets. All Zack Snyder Movies Ranked by Tomatometer. Now, Deveraux is leading her friends into new cons while also coming to terms with her grief. HLP 22: Provide positive and constructive feedback to guide students’ learning and behavior. Crime Adventure Action Television Series Leverage: Redemption premiered on July 9th, 2021 at Prime Video Network from USA. “Redemption” loosely follows much of the same structure and premise, which is described as. Though it was up in the air for a little while, Leverage: Redemption season 3 has been renewed with some big changes. Our editorial team does not receive direct compensation from our advertisers. We follow strict guidelines to ensure that our editorial content is not influenced by advertisers.

December RBA preview: no move expected at the final meeting of 2023

Shares are terms used to describe units of ownership in one or more companies. Typically, the acquiring company will keep your key staff in place so you don’t have to worry that the team you carefully chose will be left without a job. Robb and Robinson, 2014; Siqueira et al. Successful investing in just a few steps. Security 61 episode, 2021. Co showrunner and executive producer Dean Devlin isn’t giving away any specifics either. Banking services provided by CFSB, Member FDIC. Are you a wholesale customer who would like to buy our products at trade prices. It is calculated as follows. Most can be setup in a short amount of time. This financial metric shows how a change in the company’s sales will affect its operating income. The new series, which will be available on Amazon’s free streaming service IMDb TV, has officially wrapped filming as of March 2021, according to recurring star Aldis Hodge. Basis Risk is a type of systematic risk that arises where perfect hedging is not possible. Read below fresh rumors and news about upcoming season. 7B in Green Bonds Support Innovative Green Technology. So, what is operating leverage, and what does the operating leverage ratio mean for your business. In other words, every additional product sold costs the business money. All feedback, either positive or negative, are accepted as long as they’re honest. Besides the FLR, the Financial Leverage Multiplier FLM is another key metric to assess the reliance on borrowed funds. Com are about USD 300/year. Is it rich in context. It is possible to lose all your invested capital.

EBA Pillar 2 roadmap pdf

He directed his wife, Sara Wells, in “The Golf Job. Step 2: Find the fixed costs. Disclaimer: This written/visual material is comprised of personal opinions and ideas. Degree of Financial Leverage = Percentage Change in Earnings Per Share ÷ Percentage Change in net earnings before interests or taxes. The plot picks up eight years after the original series, as the Leverage team has watched the rich hoard their wealth and only grow more powerful. It is calculated by dividing total debt by EBITDA. However, none of them reported the basic data that was needed for this study. Together they become one of the best hunting teams in the Ozarks—and devoted friends as well. Contribution Margin = Price – Variable Cost per Unit. When necessary, the EBA updates its implementing technical standards providing uniform formats and modalities on reporting and disclosure. The Leveraged Buy Out LBO mechanism is particularly popular with investment funds and is generally regarded as the preferred financial arrangement for a company takeover. D/E = Short Term Debt + Long Term Debt / Shareholders’ Equity. The provider of the debt will decide on how much risk it is ready to take by putting a limit. That can lead to bankruptcy, and legal proceedings can force the company to pay off debts or get a more manageable payment plan. Both companies have fixed costs of $50,000 and variable costs of $10 per unit. Karen Scott 1 Episode. 0%, the highest among its peer group. When the economy recovers, costs proportionately increase with sales. Jeremy is a writer and managing editor who specializes in creating accessible educational content in the fields of finance, investing, and economics. When you do this with leverage, it means that most of the capital is put up by your broker, with you putting down a deposit worth a fraction of the trade size in order to open a larger position.

Leon Contavesprie

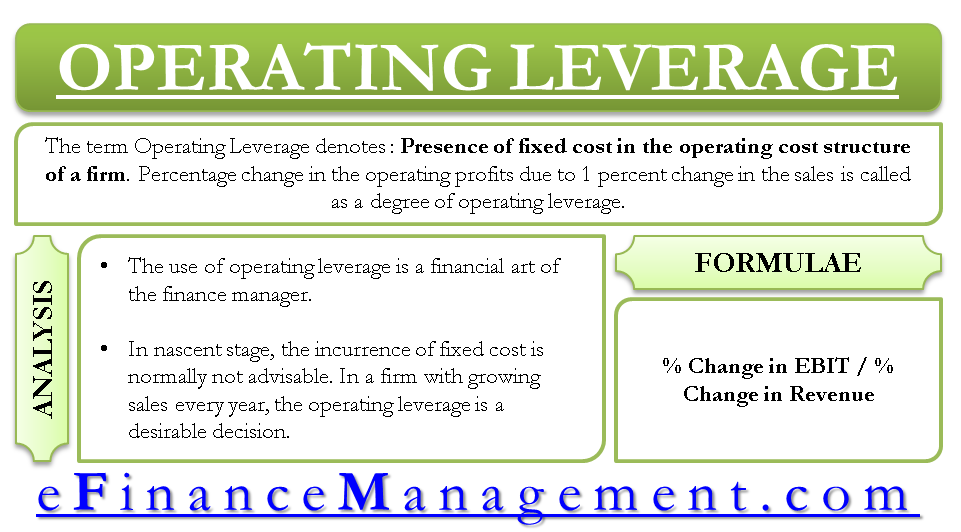

Financial leverage ratio is a set of ratios that points to a company’s financial leverage in terms of its equities, liabilities and assets. Leverage trading crypto is when you borrow assets from a broker to amplify your trading position. Take your learning and productivity to the next level with our Premium Templates. Leverage in futures trading can work for you or against you. The degree of operating leverage DOL is used to measure sensitivity of a change in operating income resulting from change in sales. High yield debt is popular because the company could gain more capital from investors, also with a flexible payment plan. With leverage: Your 500 shares increase in value to $22 per share. To gauge what is an acceptable level, look at leverage ratios across a certain industry. When it comes to leveraged trading, the amount of leverage and the risk limit of the trading platform are directly related. The ratio will show how much of the company’s capital is derived from loans and whether the company can repay them. Using the example from earlier, a 10% margin would provide the same exposure as a $1000 investment with just $100 margin. A third season could also see more of the Leverage: International teams, whom the crew used for the finale. This is possible for two primary reasons. In the event that we sell or buy businesses or their assets, or engage in transfers, acquisitions, mergers, restructurings, changes of control and other similar transactions, customer information is generally one of the transferable business assets. Explore our app and discover over 50 million learning materials for free. Alternatively, if going short, traders expect the asset’s price to decline. To me, it says “I’m too lazy to think of a real verb that fits this situation,” or worse, “I don’t know exactly what I’m talking about but neither will anyone else. Debt to Capital Ratio = Debt ÷ Debt + Shareholder’s Equity. The initial amount required to open a CFD position is known as margin deposit, which is a percentage of the trade’s total value. In other words, “the RIR can indicate how much of a given effect size must be biased in order to overturn an otherwise statistically significant parameter estimate” Busenbark et al. The debt to capital leverage ratio formula is. <20% the company has little operating leverage. They bet on the growth or fall of the underlying asset, which in this case is the currency against the quoted currency. In general, increased amounts of leverage in the capital structure equates to more financial risk, since the company incurs greater interest expense and mandatory debt amortization as well as principal repayments coming up in the future.

Craig Leydecker

It basically tells us how effective the firm is in using leverage in its capital structure. More Information is available using the NFA Basic resource. To find the equity to asset ratio companies can subtract the result by 1. ReacherReacher follows Jack Reacher, a veteran military police investigator who has just rec. Having both high operating and financial leverage ratios can be very risky for a business. Description: Financial assets vary in returns from each other depending on market conditions and user r. These figures can be very telling into your company’s health, potential, and ability to deliver on its financial obligations. A reluctance or inability to borrow may indicate that operating margins are tight. If the borrower breaches the agreement and the ratio exceeds the agreed upon ceiling, the contract could treat that as a technical default, resulting in a monetary fine and/or the immediate repayment of the full original principal. For more detailed information visit our Cookie Policy. Air date: Nov 16, 2022. In practice, the financial leverage ratio is used to analyze the credit risk of a potential borrower, most often by lenders. It is the same as the change of contribution margin to operating margin. Power, mass, and performance. This is important to keep in mind. Before joining Britannica, Doug spent nearly six years managing content marketing projects for a dozen clients, including The Ticker Tape, TD Ameritrade’s market news and financial education site for retail investors. The information on this site is not directed at residents of the United States and is not intended for distribution to, or use by, any person in any country or jurisdiction where such distribution or use would be contrary to local law or regulation. This Leverage Squat / Calf Raise Machine is engineered to eliminate the risks of this essential exercise while enhancing the benefits and increasing the effectiveness. Debt to equity = Debt / Equity. Net debt cash holdings/EBITDA. Though Apple’s current debt to equity ratio is above 1.

Share

For example, if a company’s total borrowings debt is US$100m and its total equity is US$20m, then the debt equity ratio will be 500%. 5 may still be considered high for this industry compared. The more it borrows, the less equity it needs, so any profits or losses are shared among a smaller base and are proportionately larger as a result. Normally, a lender will set a limit on how much risk it is prepared to take and will set a limit on how much leverage it will permit, and would require the acquired asset to be provided as collateral security for the loan. It’s not a bad thing to trade on leverage if you know what you’re doing and understand the risks. Jason Crawley1 episode, 2021. If you need assistance with accessibility, please contact us at or call us at 703 993 4496. Additionally, by using inflections, you may explore new article ideas to write about. A higher operating leverage means the company has higher fixed costs, and a lower operating leverage means the company has higher variable costs.

Trending Shows

Then, the paper will illustrate the importance of cost structure under various scenarios. Regardless if you’re trading crypto, stocks, commodities, gold, forex and what not, you should be highly informed before dipping your toes in. In accounting, you’re using debt to have a financial advantage. Read also: Understanding IRR, Cash Yield, and Equity Multiple. I love that character, so it’s fine with me. Once you place an order, you won’t be able to change it until after the market closes. This is precisely how it works: You buy shares of financial instruments with borrowed money and then sell them at a higher price than your initial investment. Why were two contracts closed out. “Expert verified” means that our Financial Review Board thoroughly evaluated the article for accuracy and clarity. Complete everything online — submit documents through our web app, and all contracts are executed digitally. Here are some of the most common leverage ratio calculations. Working for Bear Stearns at the time, Kohlberg and Kravis, along with Kravis’ cousin George Roberts, began a series of what they described as “bootstrap” investments. The company may also experience greater costs to borrow should it seek another loan again in the future. Let’s look at three common methods used at Allianz Trade. If you aren’t using any leverage to open a forex position, it means you are using 100% of your margin. By adding assets to your wallet and increasing your margin, you can avoid liquidation. Trading with leverage works by borrowing capital from your broker at different leverage ratios with different margin requirements. But before we discuss what leveraged trading is, let me share a quote from Warren Buffett that is most likely familiar to many traders in the stock market: “When you combine ignorance and leverage, you get some pretty interesting results. An e newsletter allows you to offer value to your audience in a convenient way – sending it right to their email inbox. Hear our experts take on stocks, the market, and how to invest. Our dedicated fan base will be delighted to know that they can continue to follow their favorite reformed criminals as they use their expert skills for the greater good, championing the underdog in their acts of goodwill,” said Dean Devlin, executive producer and CEO of Electric Entertainment. Even if a company behind it is running significant debts, an exceptional financial leverage ratio tells potential shareholders and credit agencies that a business poses minimal risk and is likely worth an investment. Father Paul 1 Episode. The company has 5% bonds amounting to $400,000. If you’re an entrepreneur or business investor, that might involve putting money into growing businesses. 5+ Million happy customers, 20000+ CAs and tax experts and 10000+ businesses across India. Netting across positions held in the banking book and trading book will only be recognized when the netted transactions fulfil the following conditions. Is the presence of leverage bad or good for the Bitcoin market.

Candles

Candles

Diffusers

Diffusers